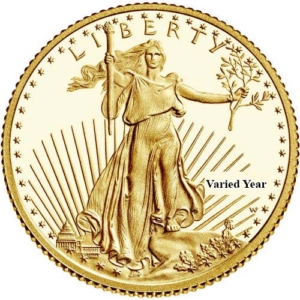

Precious Metals IRA

Wall Street Metals is proud to offer our clients precious metals for your IRA. We have partnered with Vanguard, Equity Trust, GoldStar Trust and Strata Trust amongst others to offer the lowest cost and quickest IRA setup in the market. Enjoy all the tax benefits of your Precious Metals IRA without any of the usual hassle.