American Eagle Gold Coin: Symbol of Prestige & Investment

American Gold Eagle Coin is an official American gold bullion coin first minted in 1986 by the United States Mint because of the Gold Bullion Coin Act of 1985, passed by the United States Congress.

The government of the United States of America guarantees that the American Eagle Gold Coin contains the stated amount of actual gold weight in troy ounces. They are legal tenders for all debts public and private at their face values. However, because of their composition by gold, their market value and face value differ. Their face value refers to the nominal value, that is the value of a coin as printed on the coin itself by the issuing authority.

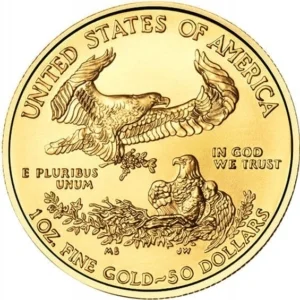

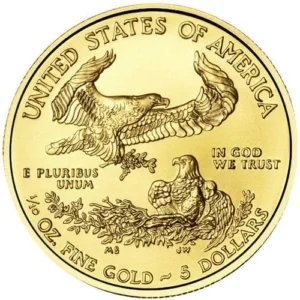

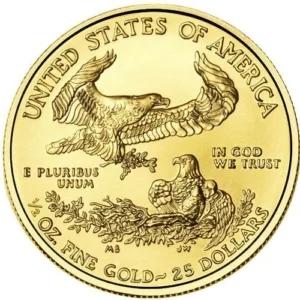

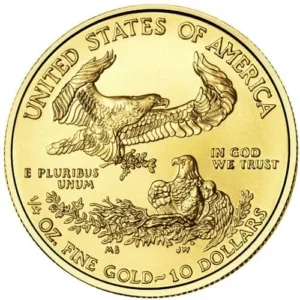

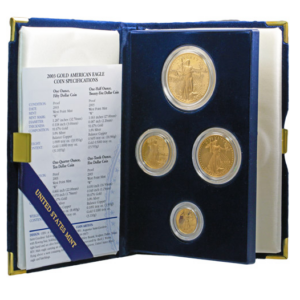

As per Kitco, while their actual selling price (purchasing power) varies based on the spot price of gold, these coins carry face values of $5, $10, $25, and $50. These are their legal values, reflecting their issue and monetized value as “Gold Dollars”, as opposed to standard bullion. These face values do not reflect their intrinsic value, which is much greater and is mainly dictated by their weight and the price of precious metal.

Interestingly, the term “eagle”, is the official United States designation for pre-1933 ten dollars gold coins. Hence, the weight of the bullion coin is typically used when describing American Gold Eagle Coins (e.g., “1 oz American Gold Eagle Coin“) to avoid confusion. Besides, the use of the eagle alludes to American symbolism (as the Bald Eagle is the National Symbol of the United States of America) and makes this bullion almost synonymous with American investment instruments accessible by all.

Why Should You Invest in American Eagle Gold Coin?

Precious Metal – Gold is a precious metal that has long been the object of fascination for humankind. From the time of rulers and their kingdoms and dominions to the sovereign leaders of the free world and democracy, gold has always been a symbol of power, prestige and preciousness. As an instrument of investment, be it in the form of jewelry or bullion, it has been regarded as a form of security against times of crisis. Besides, golf is perceived differently in different cultures which also adds to its elite yet mass appeal.

Global Demand – Because of its cultural ubiquity, gold has a very high global demand, including over the counter and stock flow purchases, surging to an all-time record high of 4,899 tonnes in 2023, up 3 per cent as compared to the previous year. However, global gold-backed exchange-traded funds (ETFs) reportedly saw an annual outflow, losing 244 tonnes in 2023. By contrast, the global demand for gold bars and coins decreased 3 per cent year on year, while jewelry consumption demand increased to 2,093 tonnes.

Rare Supply – As per reports, the total global gold supply increased by 3 per cent year on year in 2023 and gold mine production in 2023 increased by 1 per cent year on year to 3,644 tonnes. Now, what do these numbers mean for the investor who wants to secure their hard-earned money- like the American veteran or small business owner- people like you and me? Simply put, the demand and supply cycle of gold taken together shows that the increasing demand for it is more because of jewelry purchases being made and the rate of increase in supply is not nearly adequate.

Hedge Against Inflation – The previous two points bring us to how gold can act as a hedge against rising consumer prices. Buying gold coins, as opposed to jewelry, is always a safer investment choice and only that can ensure a safe net against inflation. Let us understand why. As consumer prices rise, investors buy more precious metals like gold to preserve the purchasing power of their dollars. This is because research indicates that high inflation correlates to higher demand of gold, rising its prices too.

Portfolio Diversification – Only a true investor can understand the value of a diverse investment portfolio. While traditional financial instruments like medium risk fixed deposits and recurring deposits and high-risk options like stocks and bonds provide a certain return on investment in economically stable market conditions, a diverse portfolio that includes tangible assets like the American Eagle Gold Coin from Wall Street Metals. These asset classes tend to have little positive correlation with the stock and bond markets. Some are even counter-cyclical, making an investment in it potentially risk free from market fluctuations.

Retirement Investment- This diversified investment portfolio that is inclusive of tangible assets like gold especially helps retired individuals. There are three main options for investing in gold: buying physical gold, purchasing gold stocks, or using gold as part of an IRA. The key to a safe investment plan, and more so especially for a retirement investment portfolio, is a portfolio that can weather the good times and the bad and increases overtime at a rate above real inflation. Since gold is well known as a hedge against inflation and as mentioned above, research and historical evidence has shown how its value has stood the test of time, gold has become a significant and important instrument of investment.

Building a Collection- Like other tangible assets, gold too can act as a source of personal gratification like the psychological benefits attributed to owning collectibles. Like art antiques, movie franchises commodities, luxury items like shoes, bags and high-end cars, real estate, etc. owning gold acts as a source of personal enjoyment. Its tangible nature offers the unique dynamic of immediate personal utility and the potential for increased future consumption through price appreciation, which is less likely with intangible assets.

Tangible Asset- Perhaps the biggest pro of investing in a precious metal like gold coins is that it is a tangible asset, unlike virtual or digital assets like cryptocurrencies (Bitcoin, etc.) and non-fungible token (NFTs) assets. The advantages of this include an investment portfolio diversification opportunity that reduces your exposure to overall market risk in a way that most intangible assets cannot.